Get the free cabb forms

Show details

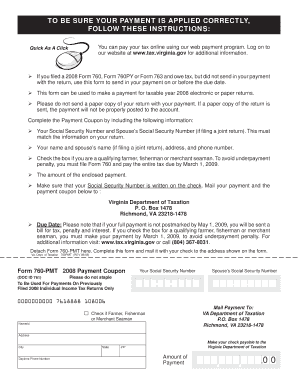

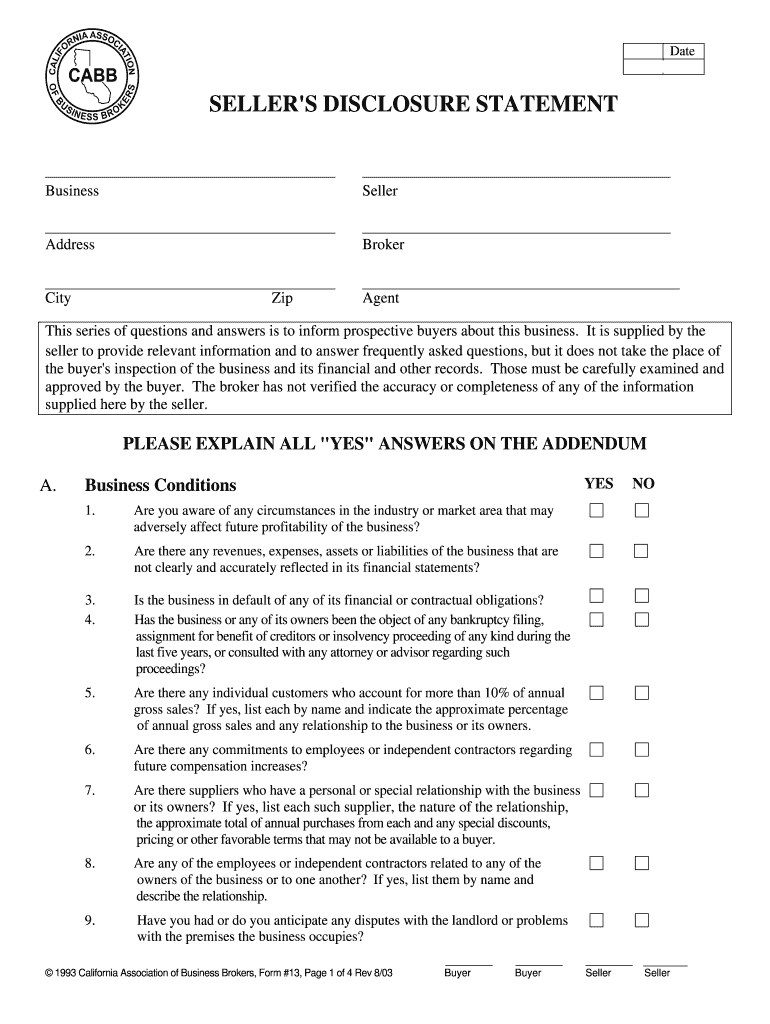

Date SELLER'S DISCLOSURE STATEMENT Business Seller Address Broker City Zip Agent This series of questions and answers is to inform prospective buyers about this business. It is supplied by the seller

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cabb form

Edit your cabb agency disclosure form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cabb seller disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cabb purchase agreement online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit oregon 81 notice works industries no download needed form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cabb form

How to fill out cabb forms?

01

Ensure you have all the necessary information and documents at hand, such as your personal details, trip details, and any supporting documents required.

02

Start by carefully reading the instructions provided on the form to understand what information needs to be filled in each section.

03

Begin by filling in your personal details accurately, including your full name, contact information, and any other required identification details.

04

Provide the details of your trip, such as the starting and ending points, dates, and any additional information related to the purpose of the trip.

05

If required, provide any supporting documents, such as receipts or invoices, to verify your trip details or expenses.

06

Double-check all the information you have entered to ensure accuracy and correctness.

07

Once all the required information has been filled out, sign and date the form as indicated.

08

Follow any additional instructions provided on the form, such as submitting it to a specific office or attaching any other necessary documents.

09

Make copies of the filled-out form and any supporting documents for your records before submitting it.

Who needs cabb forms?

01

Individuals who work as taxi drivers or own a taxi business may need to fill out cabb forms to comply with local regulations or licensing requirements.

02

Some transportation companies or organizations may also require their drivers or employees to fill out cabb forms as part of their record-keeping processes or for reimbursement purposes.

03

It is advisable to check with the local transportation authorities or your employer to confirm if cabb forms are necessary in your specific situation.

Fill

cabb counter offer form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cabb forms?

CABB forms, also known as California Association of Business Brokers forms, are standardized forms used in the field of business brokerage in California. These forms are typically used by professionals involved in buying and selling businesses to streamline the transaction process, ensure compliance with legal requirements, and provide a consistent framework for documenting and negotiating business deals. CABB forms cover various aspects of business transactions, including offers, purchase agreements, confidentiality agreements, disclosure statements, and other relevant documents.

Who is required to file cabb forms?

According to the U.S. Internal Revenue Service (IRS), CABB forms, also known as Foreign Bank and Financial Accounts Reports (FBAR), are required to be filed by U.S. persons who have a financial interest in or signature authority over one or more foreign financial accounts, and the aggregate value of those accounts exceeds $10,000 at any time during the calendar year. U.S. persons include citizens, residents, corporations, partnerships, limited liability companies, and trusts or estates.

How to fill out cabb forms?

To fill out a CABB form, follow these steps:

1. Read and understand the instructions: Start by carefully reading through the instructions provided with the CABB form. This will give you an overview of the form and what information is required.

2. Gather necessary documents: Collect all the documents and information required to complete the form. This may include personal identification documents, financial records, employment details, etc. Have them readily available.

3. Provide personal information: Begin by filling out your personal information, such as your full name, contact details, date of birth, and social security number. Ensure accuracy and legibility.

4. Complete relevant sections: Proceed to complete the sections specific to the purpose of the form. It could include sections on employment history, financial information, assets, liabilities, or any other pertinent details.

5. Use clear and concise language: Write your responses using clear and concise language. Be accurate and honest in your answers. Avoid any ambiguous or misleading information.

6. Attach supporting documents: If the form requires supporting documents, ensure you attach copies as required. These may include proof of income, identification documents, or any other evidence necessary to support your claims.

7. Review and proofread: Before submitting the form, carefully review each section for accuracy and completeness. Proofread for any errors or omissions. Make any necessary corrections.

8. Sign and date: Finally, sign and date the form in the designated spaces, confirming the accuracy of the provided information. If required, have any additional individuals involved also sign the form.

9. Submit the form: Follow the instructions provided with the form to submit it. This may involve mailing it to the appropriate address, submitting it online, or hand-delivering it to the respective organization.

Remember to keep a copy of the filled-out form and any attached documents for your records. If you have any doubts or questions, consider seeking assistance from the relevant authority, a legal advisor, or a professional who specializes in filling out these types of forms.

What is the purpose of cabb forms?

CABB (Client-Advisor-Accountant-Banker) forms are used to gather relevant financial information about a business or individual. The purpose of these forms is to assess the financial situation, needs, and goals of the client. They are typically filled out by clients seeking financial advice, tax planning, or investment management services.

By collecting information related to income, expenses, assets, liabilities, and financial goals, CABB forms help the advisor, accountant, or banker to understand the client's overall financial position. Based on this information, they can provide tailored recommendations or services to meet the client's specific needs. CABB forms ensure that all necessary financial data is gathered comprehensively and accurately, allowing for more precise financial planning and decision-making.

What information must be reported on cabb forms?

CABB forms, also known as Currency and Monetary Instruments Report (CMIR) forms, are used by individuals who are traveling with large amounts of currency or monetary instruments into or out of the United States. The information that must be reported on CABB forms includes:

1. Personal information: The full name, address, and date of birth of the person carrying the currency or monetary instruments.

2. Travel information: The flight or vessel number, date of arrival or departure, and the point of entry or exit from the United States.

3. Monetary instrument details: The type of instrument (cash, traveler's checks, money orders, etc.), the total value of each type, and the total value of all monetary instruments combined.

4. Country of origin: The country where the currency or monetary instruments were acquired.

5. Recipient details: If the currency or monetary instruments are being transported on behalf of another person or to be delivered to another person, their full name, address, and relationship to the person carrying the instruments must be provided.

It is important to note that failure to report the transportation of currency or monetary instruments exceeding $10,000 in value may result in the seizure of the funds and potential legal consequences.

How can I modify cabb forms without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your cabb forms into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out cabb forms using my mobile device?

Use the pdfFiller mobile app to fill out and sign cabb forms. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit cabb forms on an iOS device?

You certainly can. You can quickly edit, distribute, and sign cabb forms on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your cabb forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cabb Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.